HIGHLIGHTS:

- Technology speeds holiday shopping, but Black Friday still motivates

- Intel Corp.’s 14-Nanometer Technology Is Great, but Yields Still Proving Challenging

- Alibaba Seeks to Sell Stake in Chinese Technology Startup

- Celtic majority shareholder Dermot Desmond predicts creation of a British league

Technology speeds holiday shopping, but Black Friday still motivates

Technology speeds holiday shopping, but Black Friday still motivates November 22, 2015 12:00 AM

Darrell Sapp/Post-GazetteErin Rayle of Oakdale waits with a shopping cart for her and her family party of five at the Mall at Robinson during last year's Black Friday.

It’s Christmas Eve, and the little ones — who are supposed to be asleep — have their noses pressed to their frosty bedroom windows, searching the cloudy sky for the presents being delivered by ... drones.

“Physically, they are perfectly feasible,” said Willem-Jan Van Hoeve, an associate professor in the Carnegie Mellon University Tepper School of Business. “But a big hurdle for drones is the legal status. Do we allow drones to go from Point A to Point B without a physical person having them in sight? The technology is almost there or even already there. It’s just a matter of legalization.”

A great many people are nervous about the idea of unmanned aerial vehicles flying low over them.

“Amazon and others are developing these delivery drones. They’ve made great leaps in this technology,” Mr. Van Hoeve said. “But I would not want them to deploy them on a massive scale. From a delivery standpoint, they can be a great tool, but you have to be very careful. You have to think about accidents that may happen.

“I think it’s a good thing that it’s taking time for this to be adopted because it would be very bad to blindly adopt technology without looking very carefully at the consequences.”

“There’s a lot of buzz about drones,” said Jeff Inman, a professor of marketing and business administration at the University of Pittsburgh. “Amazon is taking us a step in that direction this year. They’re leading the way with a special deal for Prime subscribers that guarantees delivery up until Christmas Eve.”

But those aren’t drone deliveries. They’re done the old-fashioned way — by truck — and Amazon’s website does not list Pittsburgh among the 16 metro areas where it is available.

So where do you turn? Well, you know Dasher and Dancer and Prancer and Vixen. But do you recall Uber, the most famous app-driven vehicle service of all?

“Uber is stepping into that space, delivering right up to Christmas,” Mr. Inman said. “You could put in an order asking them to pick up the XBox you ordered in Monroeville and deliver it to an address in the North Hills. You can do that right now, but it’s a little clunky. It can’t be too long before Uber makes that service much more streamlined. They’ve got the drivers.”

Technology also is improving the tracking and delivery of goods in the more traditional ways.

BFAds.net, for example, is a website that not only enables users to find store hours and track the best bargains, but it also provides updates on shipping dates and costs.

“A couple years ago, there were ice storms that hit the Midwest and messed up the shipping and people weren’t getting their items in time for Christmas,” said David Varble, manager of the company based in Beloit, Wis. “So last year, Target and Amazon beefed up their delivery services, and then there weren’t any storms and they took some losses there. It will be interesting to see how it plays out this year.”

BFAds.net — the BF stands for Black Friday — was started in 2003 by Michael Brim, a teenager at the time who was tracking what stores had what items on sale after Thanksgiving. He realized there might be some value to the information, Mr. Varble said, and created the website.

The company, which has more than a million subscribers, gets access to advertisements weeks before they show up in the Thanksgiving newspapers and in commercials during the televised parades. You can browse on your phone and share with family and friends.

“We do a lot of the legwork for the consumer, so they don’t have to dig through everything,” Mr. Varble said. “We produce a buying guide, we have a wish list feature that’s really popular. We also can send out notifications right to your phone if a sale goes early. It really helps you stay in the know.

“A lot of merchants are purposely vague about their Black Friday information, because they want you to come to the store. They know that once they get you in the doors, you’re likely to buy different items that are not necessarily big deals. That way they can make some of their money back from the sale items.”

“Traditional marketing is very different from online marketing,” Mr. Van Hoeve said. “For example. a store like Macy’s, a big, permanent retail outlet, has very good knowledge of how to move people through the store. If you design the store a certain way, you basically guide the consumer toward interesting products and very directly influence them by displays. This has been studied for a long time.

“On the Internet, it doesn’t work like that. You can still try to guide people. but it’s a different marketing technology, a different game you play there. You can look at what do they click on and you can give other options. ’If you click on this, you might like this also.’ ”

A retail store offers sales help for your shopping, but the clerks might be busy, uninformed or biased toward making a sale. Online shoppers sitting in their homes have a greater variety of choice and can research prices and customer satisfaction. But at the store, you can feel it and try it on.

Also, people are more accustomed to shopping online. It used to be that if a store was out of stock, they’d order the product for you. Today, shoppers can save time by ordering the product themselves.

“I think a lot of shoppers are pretty savvy. They plan,” Mr. Inman said. “My family has a tradition. We stand in line and talk to other shoppers. They’ve got their lists and it’s all pretty well mapped out. There’s more cherry-picking than most stores would like to think.

“There’s still a segment of the population that sticks with the big, fat newspaper that comes out on Thanksgiving Day full of the ads. Folks sit down and figure out what they’re going to buy. Less than 10 percent of purchases this season are going to be made online. We still have 90 percent of the sales made in the brick-and-mortar stores.

“It’s not our parents’ Christmas, that’s for sure. I think we’ve landed splat in the 21st century. It’s still the time of year to go and get gifts, and I think we just need to have the right spirit. But it’s not like it used to be.”

Dan Majors: dmajors@post-gazette.com and 412-263-1456.

It’s Christmas Eve, and the little ones — who are supposed to be asleep — have their noses pressed to their frosty bedroom windows, searching the cloudy sky for the presents being delivered by ... drones.

“Physically, they are perfectly feasible,” said Willem-Jan Van Hoeve, an associate professor in the Carnegie Mellon University Tepper School of Business. “But a big hurdle for drones is the legal status. Do we allow drones to go from Point A to Point B without a physical person having them in sight? The technology is almost there or even already there. It’s just a matter of legalization.”

A great many people are nervous about the idea of unmanned aerial vehicles flying low over them.

“Amazon and others are developing these delivery drones. They’ve made great leaps in this technology,” Mr. Van Hoeve said. “But I would not want them to deploy them on a massive scale. From a delivery standpoint, they can be a great tool, but you have to be very careful. You have to think about accidents that may happen.

“I think it’s a good thing that it’s taking time for this to be adopted because it would be very bad to blindly adopt technology without looking very carefully at the consequences.”

“There’s a lot of buzz about drones,” said Jeff Inman, a professor of marketing and business administration at the University of Pittsburgh. “Amazon is taking us a step in that direction this year. They’re leading the way with a special deal for Prime subscribers that guarantees delivery up until Christmas Eve.”

But those aren’t drone deliveries. They’re done the old-fashioned way — by truck — and Amazon’s website does not list Pittsburgh among the 16 metro areas where it is available.

So where do you turn? Well, you know Dasher and Dancer and Prancer and Vixen. But do you recall Uber, the most famous app-driven vehicle service of all?

“Uber is stepping into that space, delivering right up to Christmas,” Mr. Inman said. “You could put in an order asking them to pick up the XBox you ordered in Monroeville and deliver it to an address in the North Hills. You can do that right now, but it’s a little clunky. It can’t be too long before Uber makes that service much more streamlined. They’ve got the drivers.”

Technology also is improving the tracking and delivery of goods in the more traditional ways.

BFAds.net, for example, is a website that not only enables users to find store hours and track the best bargains, but it also provides updates on shipping dates and costs.

“A couple years ago, there were ice storms that hit the Midwest and messed up the shipping and people weren’t getting their items in time for Christmas,” said David Varble, manager of the company based in Beloit, Wis. “So last year, Target and Amazon beefed up their delivery services, and then there weren’t any storms and they took some losses there. It will be interesting to see how it plays out this year.”

BFAds.net — the BF stands for Black Friday — was started in 2003 by Michael Brim, a teenager at the time who was tracking what stores had what items on sale after Thanksgiving. He realized there might be some value to the information, Mr. Varble said, and created the website.

The company, which has more than a million subscribers, gets access to advertisements weeks before they show up in the Thanksgiving newspapers and in commercials during the televised parades. You can browse on your phone and share with family and friends.

“We do a lot of the legwork for the consumer, so they don’t have to dig through everything,” Mr. Varble said. “We produce a buying guide, we have a wish list feature that’s really popular. We also can send out notifications right to your phone if a sale goes early. It really helps you stay in the know.

“A lot of merchants are purposely vague about their Black Friday information, because they want you to come to the store. They know that once they get you in the doors, you’re likely to buy different items that are not necessarily big deals. That way they can make some of their money back from the sale items.”

“Traditional marketing is very different from online marketing,” Mr. Van Hoeve said. “For example. a store like Macy’s, a big, permanent retail outlet, has very good knowledge of how to move people through the store. If you design the store a certain way, you basically guide the consumer toward interesting products and very directly influence them by displays. This has been studied for a long time.

“On the Internet, it doesn’t work like that. You can still try to guide people. but it’s a different marketing technology, a different game you play there. You can look at what do they click on and you can give other options. ’If you click on this, you might like this also.’ ”

A retail store offers sales help for your shopping, but the clerks might be busy, uninformed or biased toward making a sale. Online shoppers sitting in their homes have a greater variety of choice and can research prices and customer satisfaction. But at the store, you can feel it and try it on.

Also, people are more accustomed to shopping online. It used to be that if a store was out of stock, they’d order the product for you. Today, shoppers can save time by ordering the product themselves.

“I think a lot of shoppers are pretty savvy. They plan,” Mr. Inman said. “My family has a tradition. We stand in line and talk to other shoppers. They’ve got their lists and it’s all pretty well mapped out. There’s more cherry-picking than most stores would like to think.

“There’s still a segment of the population that sticks with the big, fat newspaper that comes out on Thanksgiving Day full of the ads. Folks sit down and figure out what they’re going to buy. Less than 10 percent of purchases this season are going to be made online. We still have 90 percent of the sales made in the brick-and-mortar stores.

“It’s not our parents’ Christmas, that’s for sure. I think we’ve landed splat in the 21st century. It’s still the time of year to go and get gifts, and I think we just need to have the right spirit. But it’s not like it used to be.”

Dan Majors: dmajors@post-gazette.com and 412-263-1456.

Intel Corp.’s 14-Nanometer Technology Is Great, but Yields Still Proving Challenging

On Nov. 19, Intel (NASDAQ:INTC) hosted its annual investor meeting. At these annual events, the company usually provides substantial insight into its business, both from a high-level strategic perspective and -- particularly in the case of the presentation from the CFO -- the lower-level "nuts and bolts," so to speak.

This year, Intel's Bill Holt -- the individual responsible for the company's chip manufacturing technology development -- had a very interesting and informative presentation discussing the company's latest 14-nanometer chip manufacturing technology.

In a nutshell, the technology itself seems great, as you'll soon see, but it's clear the company is still facing yield issues with the technology. Without further ado, let's take a closer look at the content from this presentation.

A very thorough explanation of the density advantage of Intel's 14nm technology Intel has claimed for quite a while that its 14-nanometer chip manufacturing technology offers better transistor density than competing 14-nanometer and 16-nanometer technologies from Samsung (NASDAQOTH:SSNLF) and TSMC (NYSE:TSM), respectively.

Higher transistor density means that, in theory, Intel can cram more functionality into a given area than its competitors can, or it can deliver similar products but at lower cost thanks to the smaller chip area.

This claim has actually been called into question by a number of folks in the press and the investment community. The doubt arises from the fact that Apple's (NASDAQ:AAPL) A8 and A9 processors, built on TSMC's 20-nanometer and 14/16-nanometer processes from both foundries, respectively, seem to be able to pack in more transistors into a smaller area than Intel's latest PC processors.

Holt conceded that a straight division of the number of transistors in its two lead 14-nanometer products -- Broadwell-U (2+2 configuration) and Skylake-U (2+2 configuration) -- by the chips' respective die sizes indicates that Intel's 14-nanometer technology is actually less dense than the foundry 14/16-nanometer processes (see the image below).

Source: Intel.

However, Holt pointed out that these comparisons aren't actually that informative as the average transistor density of a processor depends on the kinds of transistors/devices used to build the chip. Some devices are quite dense while others can take up quite a lot of space.

Normalizing for the different compositions of these chips, Intel claims its 14-nanometer technology has a pretty significant edge in terms of density, consistent with the company's published gate pitch/metal pitch metrics:

Source: Intel.

In other words, if Intel's analysis is to be trusted (and I do trust it), the company's 14-nanometer technology delivers a pretty substantial advantage in terms of transistor density relative to the 14/16-nanometer technologies from its competitors.

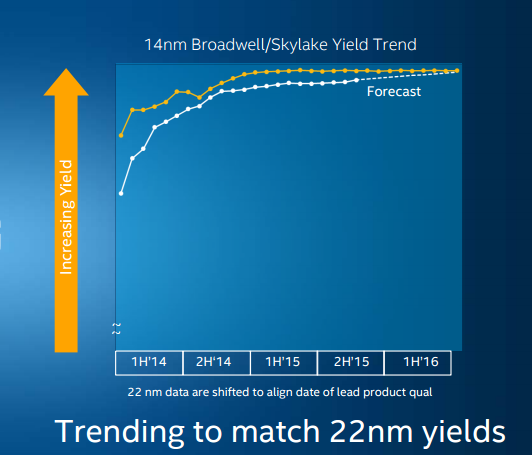

That's great, but what about yields? Although Intel's 14-nanometer technology looks great from a density perspective (and performance/power of products in the marketplace looks quite good), Intel showed some data indicating that manufacturing yields on this technology are still behind where the company had expected them to be this time last year:

Source: Intel.

Indeed, although Intel had originally hoped it would be able to get yields of its lead 14-nanometer products (Broadwell and Skylake dual-core processors with GT2 graphics configurations) to match the yields of its lead 22-nanometer product (Haswell dual core with GT2 graphics) by the second half of 2015 as you can see in the image below:

Source: Intel.

Obviously, Intel hasn't improved its 14-nanometer yields at the rate it had originally hoped to.

If you take a look at the following slide, you'll see how Intel expects these yield issues to manifest themselves in terms of product costs:

Source: Intel.

If you study this image closely, you'll notice that Intel is projecting significant increases in product costs for 2016 in the performance segment. Much of the volume Intel shipped in this segment during 2015 was on the 22-nanometer node, so the increase in 2016 seems to be attributable to the fact that Intel is transitioning these products will see a broad transition to products built on the 14-nanometer node.

In the mainstream segment, Intel has actually been shipping 14-nanometer products in volume for quite a while, particularly in laptops. This is why we saw a big jump in cost from 2014 to 2015, but as yields improve, costs should come down in 2016. The same phenomenon appears to be in play in the value segment (remember that Intel launched its first "value" 14-nanometer parts in 2015 in the form of Braswell and cut-down Broadwell models).

Additionally, during CFO Stacy Smith's presentation, the executive said that although the company's data center group is expected to grow sales at a "mid-teens" percentage rate but that operating profit will only grow "in the low double digits."

This, Smith indicated, is due to the fact that the company will be transitioning its product line there from the 22-nanometer manufacturing technology to the 14-nanometer technology, which is expected to lead to increased product costs (negatively impacting gross profit margins and, ultimately, operating margins).

Intel's 14-nanometer is great technology, but the yield situation looks tough It's hard to deny that Intel was able to achieve some very impressive area scaling with its 14-nanometer technology, and as somebody who owns multiple products built on Intel's 14-nanometer technology, I've seen firsthand how good products built on this technology can be. But it's also difficult to ignore the fact that the company has struggled with manufacturing yields, missing its own forecasts with respect to yield improvement.

3 Companies Poised to Explode When Cable DiesCable is dying. And there are 3 stocks that are poised to explode when this faltering $2.2 trillion industry finally bites the dust. Just like newspaper publishers, telephone utilities, stockbrokers, record companies, bookstores, travel agencies, and big box retailers did when the Internet swept away their business models. And when cable falters, you don't want to miss out on these 3 companies that are positioned to benefit. Click here for their names. Hint: They're not the ones you'd think!

Ashraf Eassa owns shares of Intel. The Motley Fool owns shares of and recommends Apple. The Motley Fool recommends Intel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Alibaba Seeks to Sell Stake in Chinese Technology Startup

Nov. 22, 2015 2:44 a.m. ET

BEIJING—E-commerce giant Alibaba Group Holding Ltd. BABA 2.67 % is looking to offload its stake in China’s leading online provider of services ranging from movie tickets to restaurant bookings as it builds a competing platform of its own, according to people familiar with the situation.

Alibaba is shopping its roughly 7% stake in the company created by last month’s merger of two rivaling startups: Meituan.com and Dianping Holdings Ltd., whose services are similar to Groupon Inc. GRPN -2.51 % and Yelp of the U.S. The Alibaba deal could be worth around $1 billion, based on the valuations being discussed in Meituan-Dianping’s current fundraising round, the people said.

One person said, however, that investors are seeking a discount on Alibaba’s stake because Meituan-Dianping is offering investors a “ratchet” clause in its continuing fundraising round. That means investors would be given additional shares if the company’s future IPO price is below the valuation they pay in this current round. Alibaba’s stake doesn’t offer a prospective buyer those same terms.

The Alibaba sale of existing shares comes at a time when Meituan-Dianping is raising fresh funds from investors to fund its expansion plans. Meituan-Dianping has been seeking to raise up to $3 billion from investors, putting it at a roughly $20 billion valuation including the fresh capital, people familiar with the situation said earlier.

The discussions are fluid and the valuations could change depending on investor interest and terms offered.

Rather than hold on to its small stake in Meituan, Alibaba wants to focus its efforts on developing its own food-delivery platform, Koubei, because it is one that the e-commerce giant can fully control, one of the people said. Koubei—which means “word-of-mouth reputation” in Chinese—is a joint venture set up in June by Alibaba and its financial affiliate, which together injected nearly $1 billion into it.

China’s Internet giants have sought to expand their shares of the fiercely competitive market for smartphone applications connecting users with brick-and-mortar services such as taxis, food deliveries, restaurant bookings, and movie ticketing.

Many startups have burned out in the battle to attract users with heavy discounts and subsidies, but the likes of Alibaba and Tencent say they have deep pockets and supporting services such as maps, data and payments platforms to give them an edge over rivals.

Alibaba’s move to exit Meituan-Dianping as Tencent builds a position in the company shows that there are limited scenarios in which the two rival Internet giants would collaborate.

One rare instance of such collaboration arose in February when rival car-hailing apps separately backed by Alibaba and Tencent merged to create a dominant player. That merger worked for both companies because they don't have their own operations in the space, one person familiar with the deal said, whereas in the case of Meituan-Dianping, Alibaba has its own rivaling company to support.

Alibaba’s executives have said the company’s dominance in e-commerce can translate to success in the offline, local services niche, pointing to the heavy traffic of hundreds of millions of users of its shopping app Taobao and affiliated payments business, Alipay. The company also has a mapping arm and other assets that can support such a business, they have said.

Rather than run its own operations, Tencent’s strategy has been to take minority stakes in other tech companies and use the alliances to offer a wider range of services on the company’s messaging and social-networking applications, which also have hundreds of millions of users. The investment in Meituan-Dianping is in line with such a strategy.

Search giant Baidu Inc., BIDU -0.53 % sometimes called China’s Google, has also been spending heavily to win share in the market because it sees the services as blending in with its lucrative search and map business to boost revenue through commissions from merchants.

— Li Yuan in Hong Kong contributed to this article.

Celtic majority shareholder Dermot Desmond predicts creation of a British league

Talk of Celtic and Rangers moving into the English league has long been mooted but has never come close to happening, but Desmond claims top clubs south of the border will eventually engineer change. The Barclays Premier League has a £5.1billion television deal in place for the next three seasons while the Scottish league's current deal is worth around £15million a year. But Desmond believes individual clubs will soon wield more power. The Irishman told STV: "Our concentration is to win the Scottish Premier League. As far as developing other leagues, I think technology is going to change and evolve how football is sold in the future. "Before it was a monopoly with either terrestrial TV or satellite TV, now everybody has the ability to broadcast their results and performances. "In the future I think there will be different types of negotiations between teams and leagues that will evolve into more competitive leagues in the British Isles. "I'm taking a 10-year view, what we see in the English Premiership today I don't think will be around in 10 years' time, I think there will be a British Premiership. "In Italy and in Spain you have the bigger clubs like Barcelona and Real Madrid who negotiate their own football contracts, because they are more advantageous to them. "I think that will happen in the UK with Manchester United, Liverpool and Arsenal and then I think they will institute a change in the structure of the league."

Please kindly share your comments with us. We will be so glad if you do. Thanks in anticipation.

No comments:

Post a Comment